new orleans sales tax percentage

The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is. Did South Dakota v.

Pennsylvania Sales Tax Guide For Businesses

Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6.

. Within New Orleans there are around 51 zip codes with the most populous zip code being 70122. You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables. Average Sales Tax With Local.

The state general sales tax rate of Louisiana is 445. The median property tax in Orleans Parish Louisiana is 1131 per year for a home worth the median value of 184100. Louisiana Sales Tax on Car Purchases.

What is the sales tax rate in New Orleans Louisiana. What is the sales tax rate for the 70118 ZIP Code. For tax rates in other cities see.

The 2018 United States Supreme Court decision in South Dakota v. The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. What is the sales tax rate in Orleans Parish.

This is the total of state parish and city sales tax rates. Cities andor municipalities of Louisiana are allowed to collect their own rate that can get up to 7 in city sales tax. New Rate Effective on all renewals on and after 1212019.

There are also local taxes of up to 6. The County sales tax rate is. What is the sales tax in Louisiana 2021.

The minimum combined 2022 sales tax rate for Orleans California is. Interactive Tax Map Unlimited Use. The estimated 2022 sales tax rate for 70118 is 945.

Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. Orleans Parish collects on average 061 of a propertys assessed fair market value as property tax. All property tax bills for 2022 have been mailed and are also available online.

You can print a 945 sales tax table here. Homeowners will have until March 15 to submit tax bill payments before interest accrues at 1 percent per month. Sales Tax provides a number of services for businesses and citizens in New Orleans.

Pay High Alcoholic Content Wholesale Dealer Excise or License Tax. All establishments are required to charge 5. Delinquent payment penalties at the rate of 5 of the tax for each month or por-tion of month until the return is filed up to an aggregate.

New Orleans LA Sales Tax Rate. The Parish sales tax rate is. Yes sales tax is required on all food items.

Louisiana collects a 4 state sales tax rate on the purchase of all vehicles. Refund Overpaid or Miscalculated Sales Taxes. Change Business Mailing Address.

Restaurants Lounges and Nightclubs State of Louisiana. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. The Louisiana sales tax rate is currently.

Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112. What is the sales tax in Louisiana 2021. What is the sales tax on food in New Orleans.

The estimated 2022 sales tax rate for 70118 is 945. Orleans Parish Sales Tax Rate. The City of New Orleans tax rate is 5.

The City of New Orleans sales tax rate on renting of any sleeping room. 2020 rates included for use while preparing your income tax deduction. Sales Tax Rate.

The latest sales tax rate for New Orleans LA. Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax. Request for a waiver of penalty.

New Orleans has parts of it located within Jefferson Parish and Orleans Parish. 150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests. 2021 List of Louisiana Local Sales Tax Rates.

This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels. There are a total of 265 local tax jurisdictions across the.

To review these changes visit our state-by-state guide. The Louisiana state sales tax rate is currently. Has impacted many state nexus laws and sales tax collection requirements.

Establishments in the City of New Orleans and the New Orleans airport must also regis-ter for collect and remit the EN. The current total local sales tax rate in New Orleans LA is 9450. The December 2020 total local sales tax rate was.

Louisiana is ranked 1277th of the 3143 counties in the United States in order of the median amount of property taxes collected. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. The 2018 United States Supreme Court decision in South Dakota v.

The definition of a hotel according to Sec. This is the total of state and parish sales tax rates. 2022 List of Louisiana Local Sales Tax Rates.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. The five states with the highest average combined state and local sales tax rates are Louisiana 955 percent Tennessee 9547 percent Arkansas 948 percent Washington 929 percent and Alabama 922 percent. Which state has highest sales tax.

Did South Dakota v. The average cumulative sales tax rate in New Orleans Louisiana is 943. Yes sales tax is required on all food items.

The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5. The City of New Orleans tax rate is 5. How much is tax on food in New Orleans.

Sales Tax Holidays Politically Expedient But Poor Tax Policy The New Orleans sales tax rate is 945 What is the sales tax in Louisiana 2021. The California sales tax rate is currently. Mailing Address Change Request.

Many dealerships allow you to trade-in your old car in exchange for a credit applied to the price of a new vehicle. Hazardous Material Fee Renewal. The sales tax jurisdiction name is Orleans which may refer to a local government division.

Ad Lookup Sales Tax Rates For Free. For example you could trade-in your old car and receive a 5000. The New Orleans sales tax rate is.

New Rate Effective on all renewals on and after 1212019. There is no applicable city tax or special tax. The City of New Orleans tax rate is 5.

The Orleans sales tax rate is. This is the total of state county and city sales tax rates. The Orleans Parish sales tax rate is.

State And Local Sales Taxes In 2012 Tax Foundation

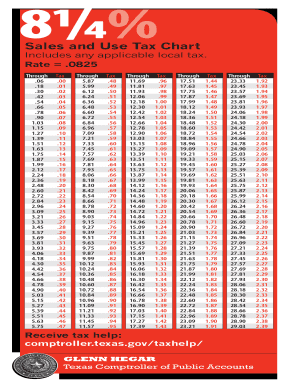

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow

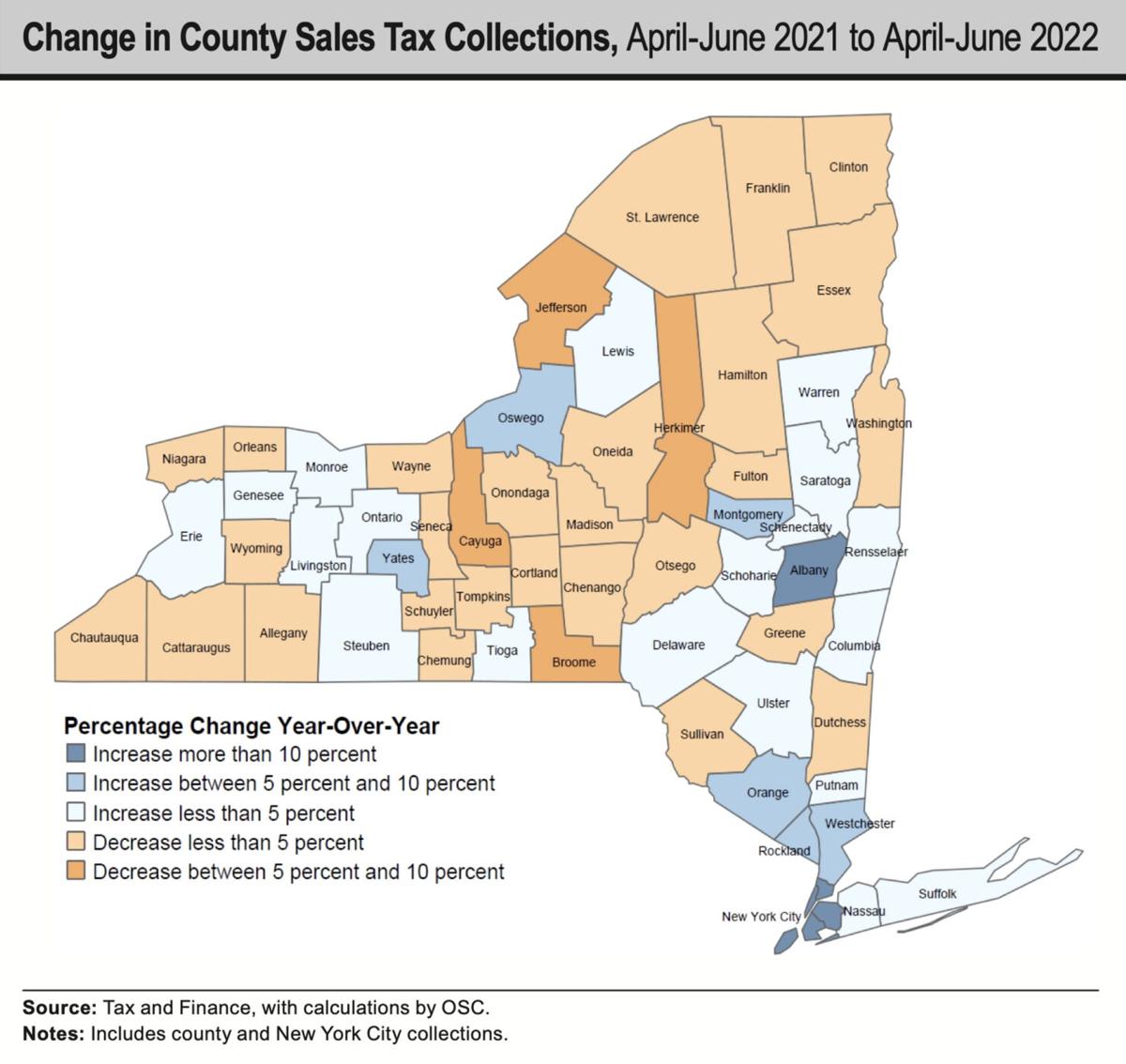

State Report Glow Region Sees Second Quarter Slowdown In Sales Tax Revenues Top Story Thedailynewsonline Com

Indiana Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

Local Counties Sales Tax Numbers For 2015 Mirror Statewide Split The Daily Gazette

New Orleans Louisiana S Sales Tax Rate Is 9 45

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Internet Sales Taxes Tax Foundation

Louisiana Vehicle Sales Tax Fees Find The Best Car Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Which Cities And States Have The Highest Sales Tax Rates Taxjar

State And Local Sales Tax Rates 2013 Map Income Tax Payroll Taxes

Louisiana Sales Tax Small Business Guide Truic

Sales Tax Holidays Politically Expedient But Poor Tax Policy