defer capital gains tax stocks

Hold Your Stocks In A Qualified Retirement Account Buying and holding dividend stocks for qualified retirement. Another strategy to lower crypto taxes is to offset capital losses against capital gains.

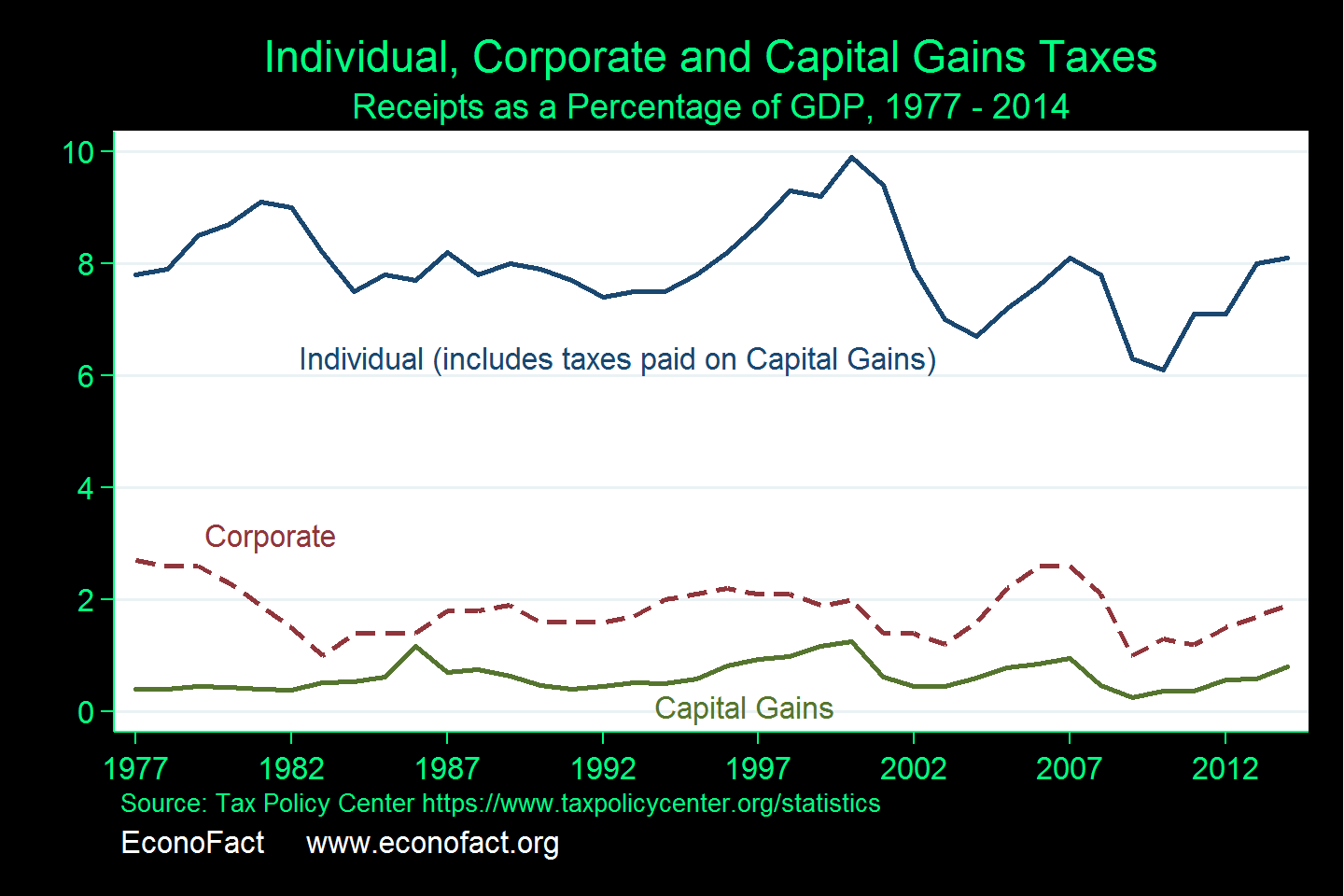

The Capital Gains Tax And Inflation Econofact

In order to understand capital gains tax deferral strategies it is first necessary to understand what a gain is in the first place.

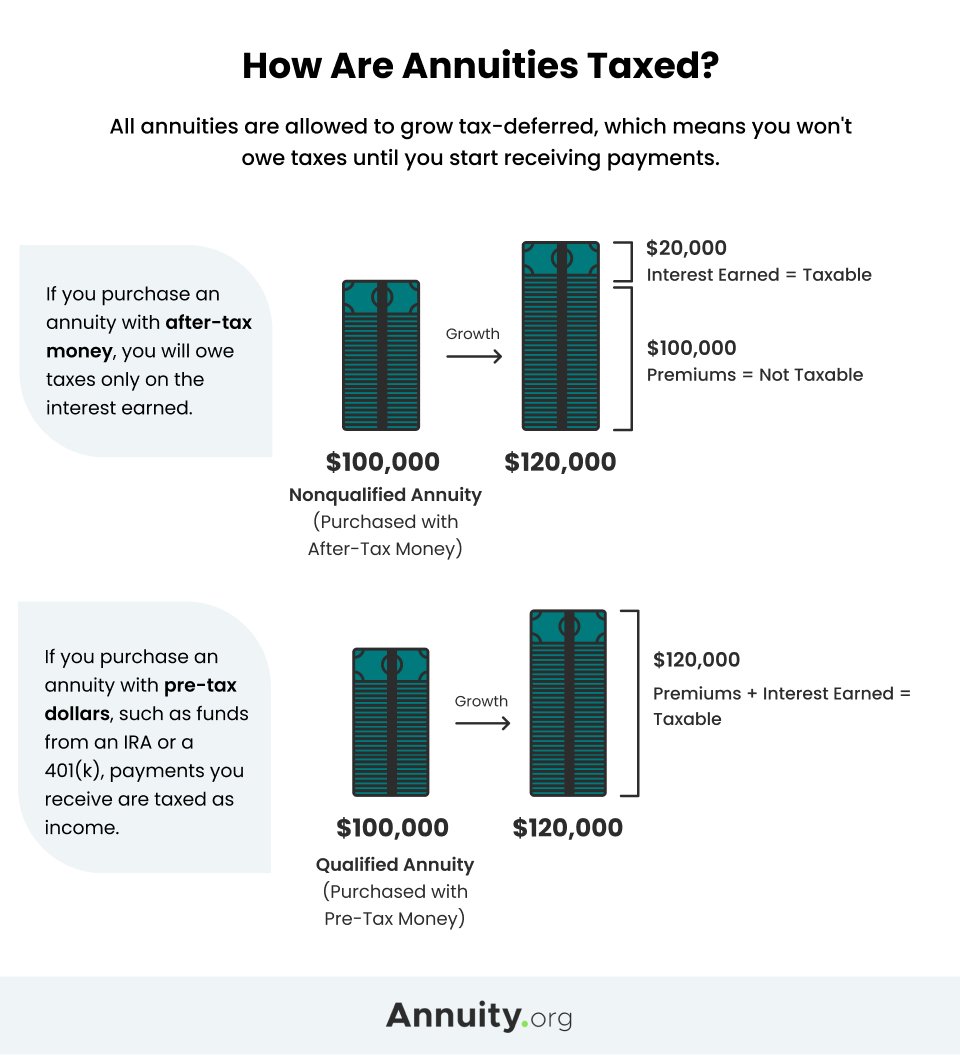

. If the funds are left in the QOF for at least five years the basis increases to 10 of the deferred gain. Owners of highly appreciated assets are often highly reluctant to sell because of the capital gains taxes that are typically due upon closing. The tax you pay on your investment income is called capital gains tax and the rules are different from your standard income taxes.

Businesses can be sold by. So for example if an investor purchased a property for 1000000 and sold it ten years later for 200 See more. By investing in eligible low-income and distressed communities you can defer taxes and potentially avoid capital gains tax on stocks altogether.

The Monetized Installment Sale MIS purports to work around this allowing you to have the overwhelming bulk of the proceeds available for whatever purpose you want while. These capital gains defer taxation until the end of 2026 or whenever the asset is disposed of whichever is first. If you have 50000 in long-term gains from the sale of one.

Starting with 4 ways to eliminate capital gains taxes on stocks. B the total capital gain from the original sale. Also keep in mind that the stock sales.

There are a few other exceptions where capital gains may be taxed at rates greater than 20. 5 ways to avoid paying Capital Gains Tax when you sell your stock Stay in a lower tax bracket. The taxable part of a gain from selling section 1202 qualified small business stock is.

Move to a tax-friendly state. Offset Capital Gains with Capital Losses. Investors who sold stocks bonds options or other securities will have to prepare Form 8949 Sales and Other Dispositions of Capital Assets and Schedule D Form 1040 Capital Gains and.

E the proceeds of disposition. You will owe tax on this 1000 capital gain during the tax year when you sold the asset. Capital gains deferral B x D E where.

Second capital gains placed in Opportunity Funds for a. Simply a gain on sale is the difference between a propertys cost basis and its sale price. Consider selling investments that have.

Capital losses from investmentsbut not from the sale of personal propertycan be used to offset capital gains. In other words 10 of the original gain is tax-free. If the funds are left in the.

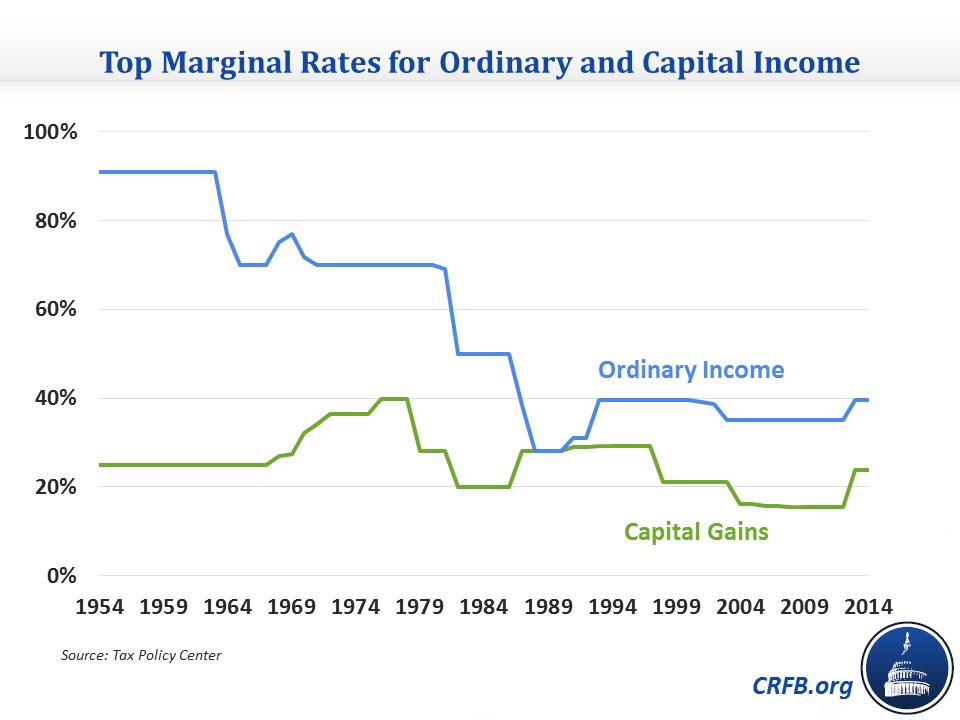

If the tax rate were to rise to 434 2 2 Close The plan issued by the Biden presidential campaign proposed to increase long-term capital gains tax rates to the level of. Understanding how capital gains taxes. To qualify you must invest.

This article will explore three different methods to defer or avoid capital gains tax on stock sales while also being able to extract some liquidity. D the lesser of E and the total cost of all replacement shares.

Managing Tax Rate Uncertainty Russell Investments

Tax Efficient Investing Why Is It Important Charles Schwab

Time Is Running Out To Defer Capital Gains Taxes What You Need To Know Caliber

Capital Gains Tax In The United States Wikipedia

What Is Tax Gain Harvesting Charles Schwab

Minimize Defer Capital Gains Taxes Toplitzky Co

How 1400z Opportunity Zone Investment Drastically Reduces Capital Gains Certified Tax Coach

Tax Deferral How Do Tax Deferred Products Work

Seo Content Tax News Dec 2019 How To Defer Avoid Paying Capital Gains Tax On Stock Sales

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Capital Gains Tax Deferral Capital Gains Tax Exemptions

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Deferring Capital Gains Potential Benefits Russell Investments

How Long Can You Defer Capital Gains Tax

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

How To Use A 1031 To Defer Capital Gains Tax Blue Chip Partners